The amount of data that business owners can use is constantly growing and becoming more complex. This can spell trouble for a business that isn’t equipped to manage or utilize the available information.

Fortunately, the potential benefits of big data far outweigh the negatives, and this is equally true for small ecommerce businesses. With adequate planning and clear objectives, you can leverage big data in multiple ways.

In this post, we’ll explore four ways to make big data work for you. These applications are goal-oriented, require little upfront investment, and deliver speedy returns. Let’s take a closer look!

An Introduction to Big Data (And Why It Matters)

In a nutshell, big data refers to large volumes of information. These are data sets so substantial and complex that they are unwieldy and difficult to manage with traditional methods.

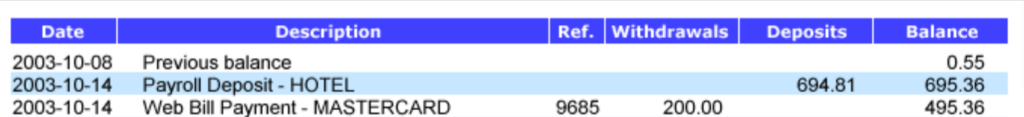

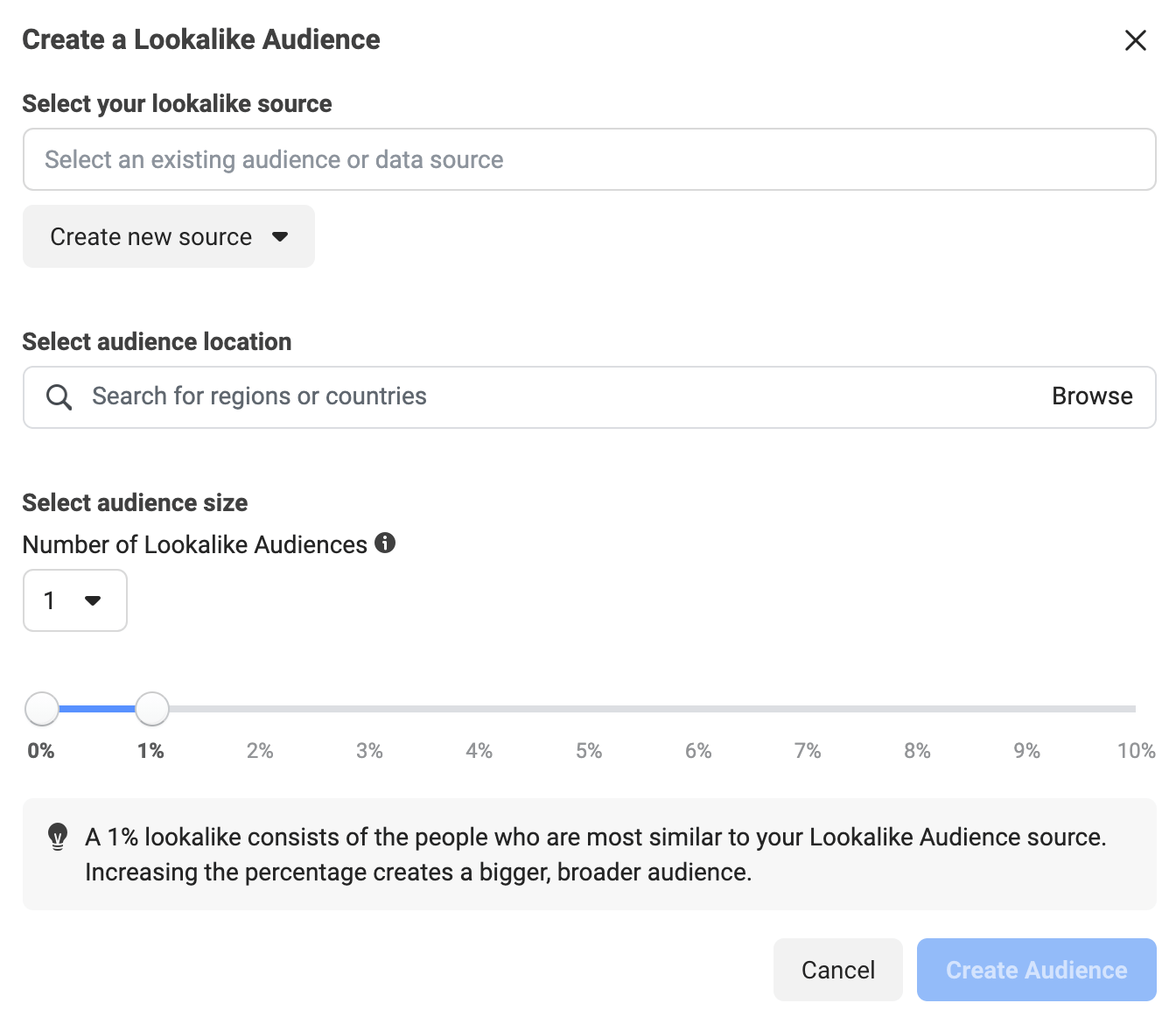

Big data can be structured or unstructured. Structured data includes customer contact information, transaction histories, or anything that can fit neatly into a spreadsheet:

In contrast, unstructured data includes social media content, customer reviews, or anything without a predefined format. The latter can require more advanced storage techniques such as data lakes.

Both of these types of big data are important for small business owners because of the valuable insights they can provide. Learning more about your customers and their behaviors means you can offer better services and streamline your operations.

Since so much business happens in the digital world, big data affects small business owners just as much as giant corporations. Let's now see how your small ecommerce venture can utilize this information.

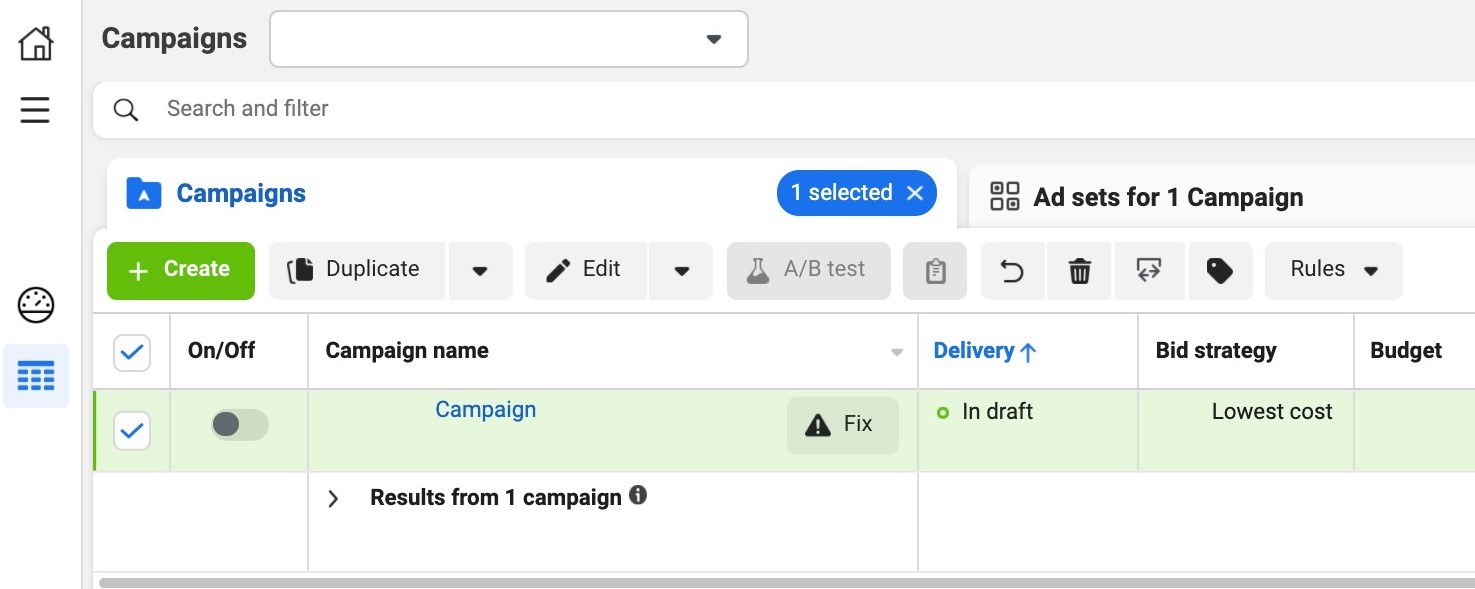

4 Ways Small Ecommerce Businesses Can Use Big Data

There are so many ways that small businesses can utilize big data, and it would be overwhelming to take all of them on. The applications we’ve listed here are starting points for improving customer retention, boosting sales, and making your processes more efficient.

To collect big data, we recommend using software such as AFS Analytics:

This powerful tool uses real-time monitoring and reporting to show you customer data related to engagement, conversions, buyer journeys, and more. We'll also explore some free data collection methods later in this article.

1. Improve Customer Service

Quality customer service is one of the most crucial elements of running any successful business. When customers feel taken care of, they’re more likely to recommend the business to others and become repeat buyers.

One of the major advantages of doing business in the digital age is that almost all consumer interactions can be turned into learning opportunities. Each time a customer makes contact, whether to ask a question, make a complaint, or leave a review, you can use the event to improve customer service.

You might utilize big data by monitoring response times across various communication channels. Customers have different wait time expectations for each platform.

For example, consumers using live chat will wait an average of 35 seconds for a response before leaving. By monitoring your communication delays across all channels, you can identify any weak spots.

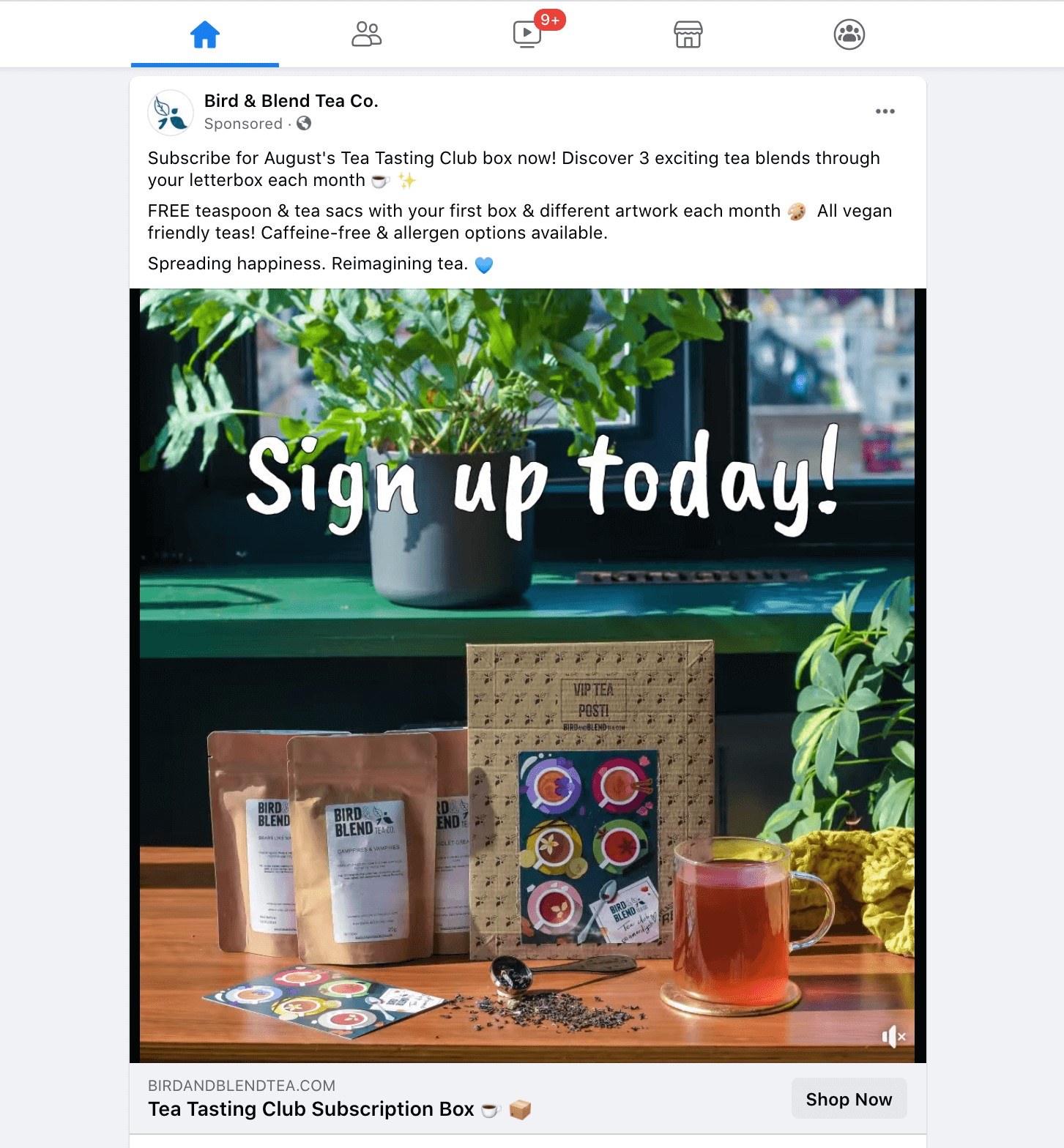

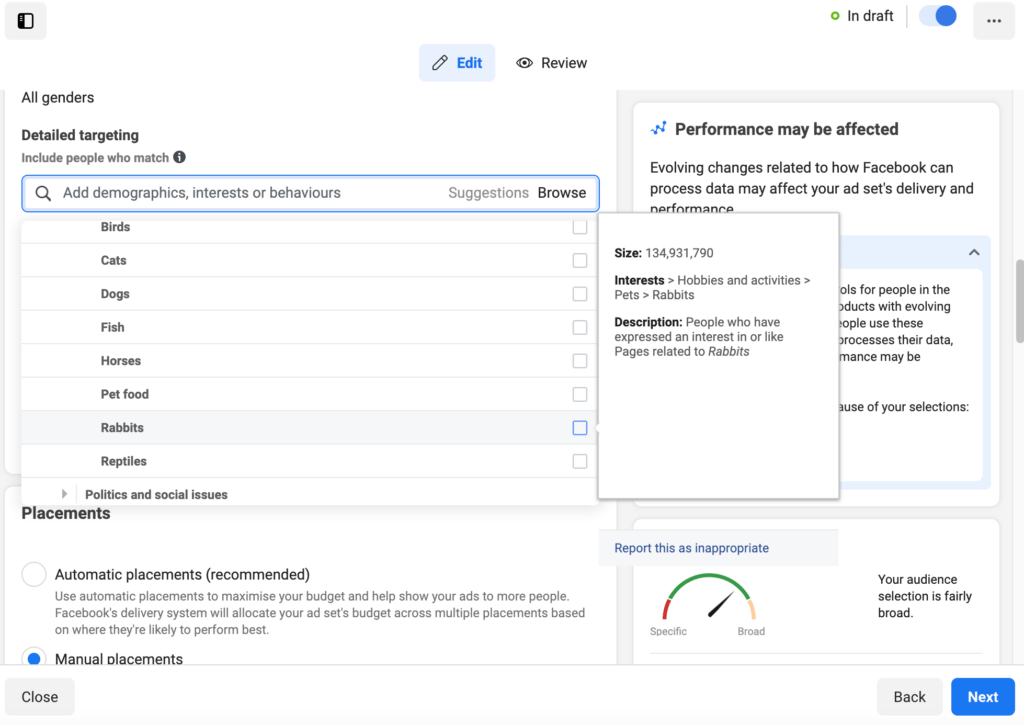

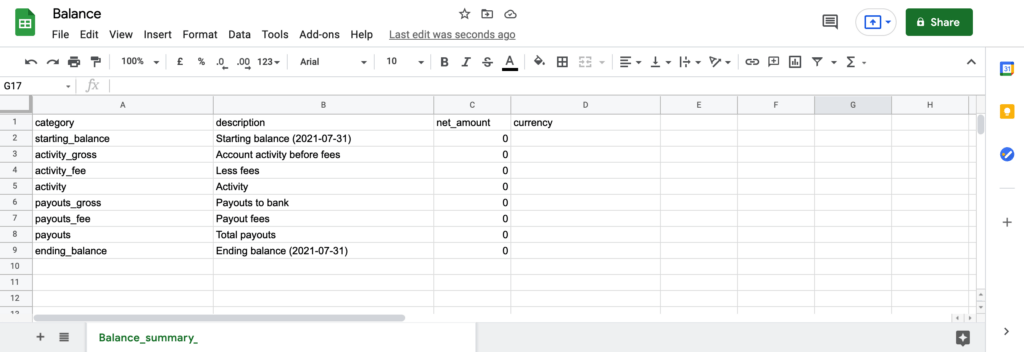

2. Create Buyer Personas

Buyer personas are important tools for any business. They are fictional representations of your target audience.

These representations can contain superficial information such as ages, locations, genders, and job titles. They can also focus on more nuanced information like challenges, desires, and objections.

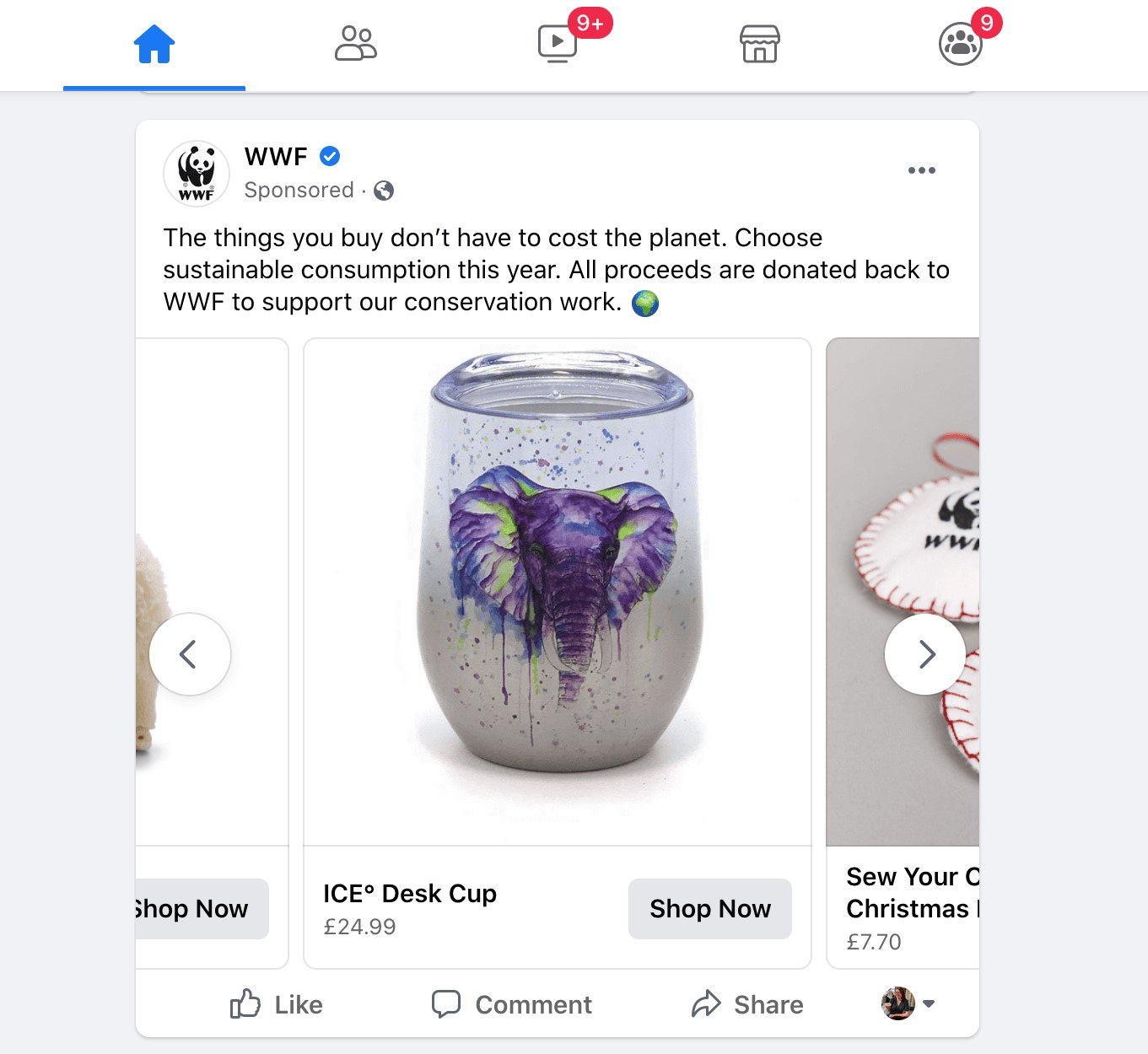

Customer personas can be useful for ecommerce businesses because they help with personalization and targeted marketing — the modern consumer has little patience for marketing that isn’t relevant.

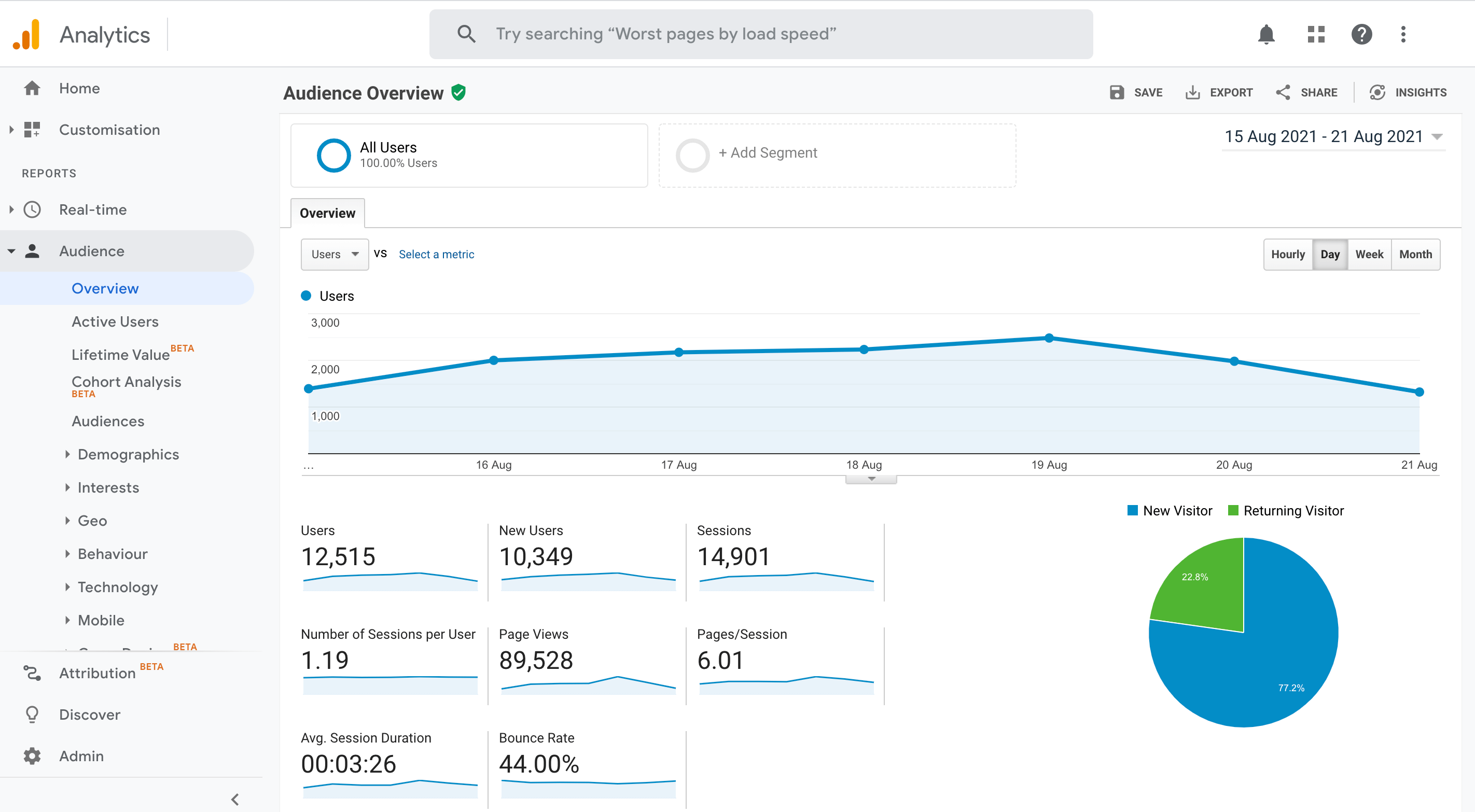

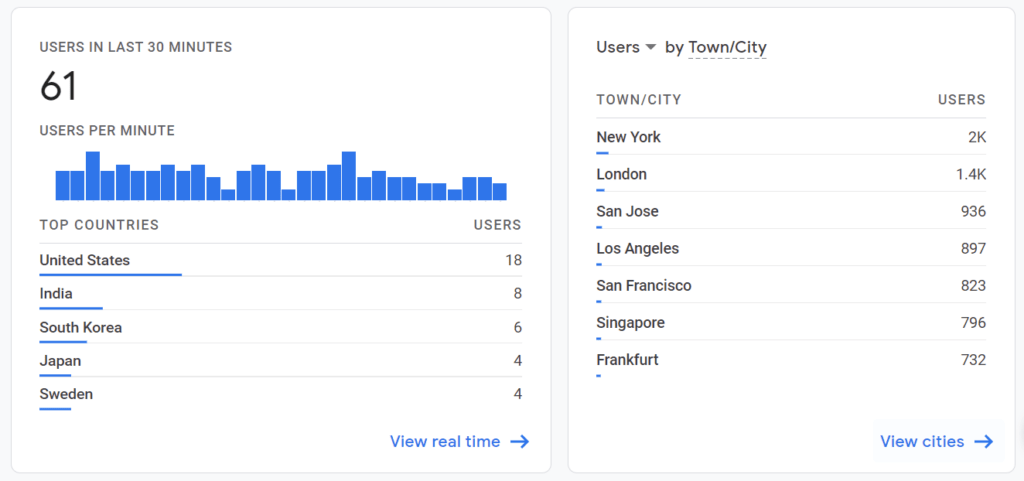

A straightforward, free way to create buyer personas is to use Google Analytics. You can take a look at the location, gender, and interest data in the Demographics section to understand your ideal customers:

To get the most of the demographic data available to you, you may have to tweak a few settings. However, there are some clear instructions that make the process easier.

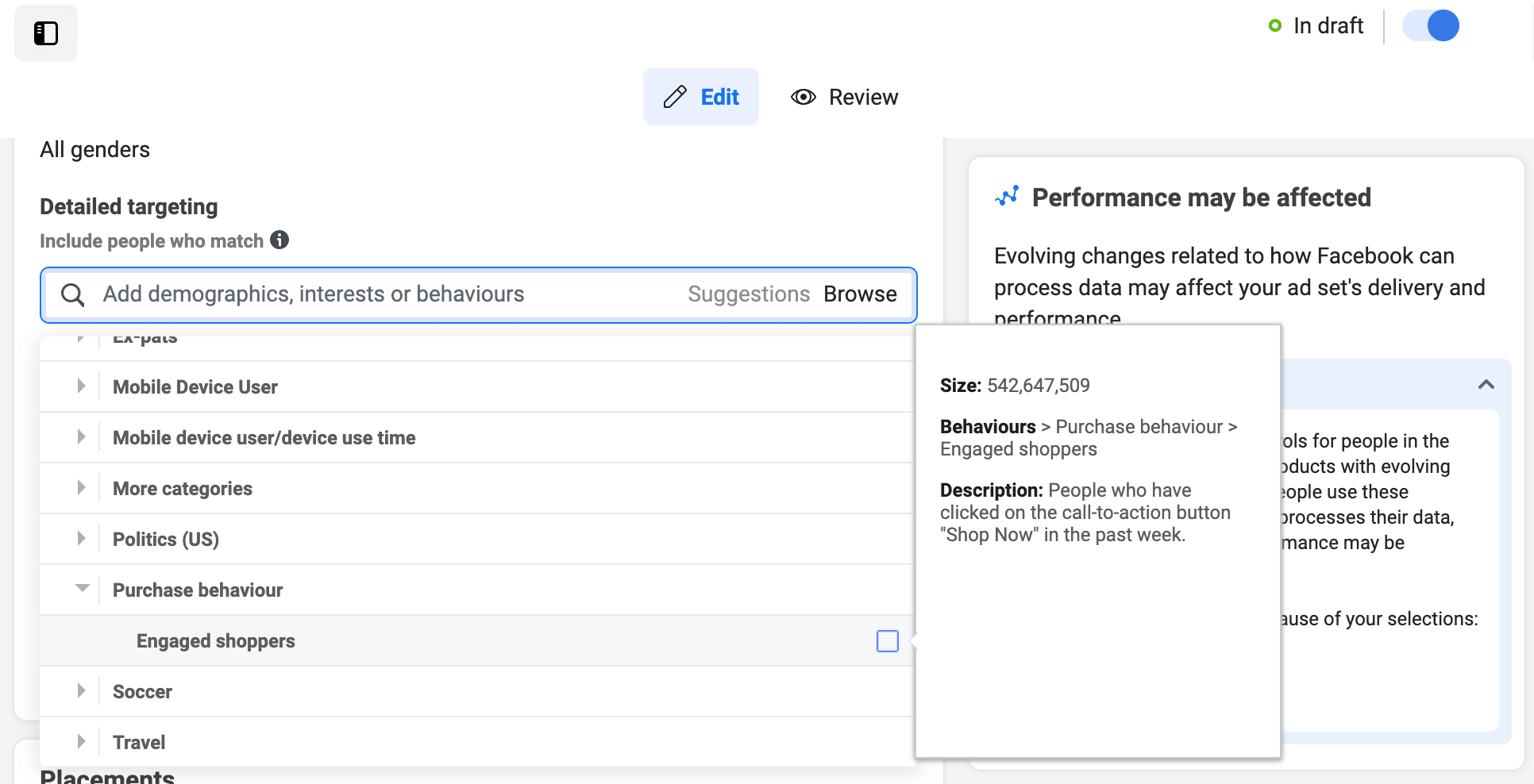

3. Decrease Cart Abandonment

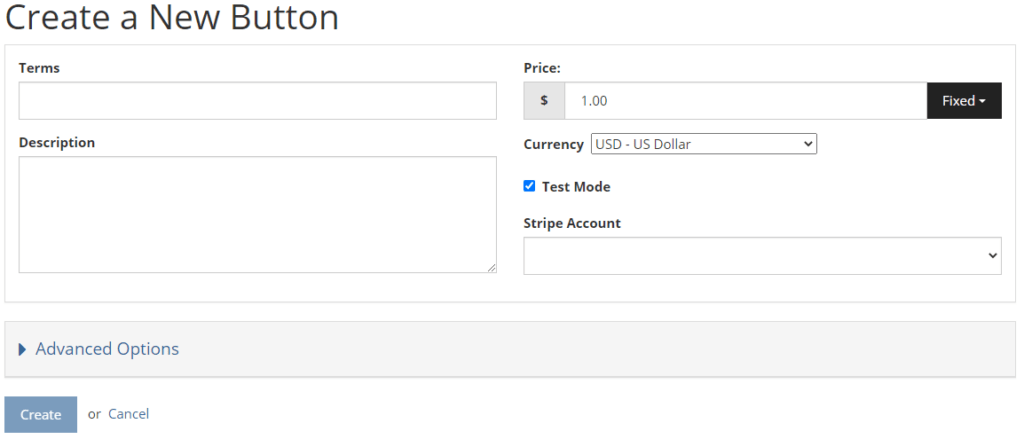

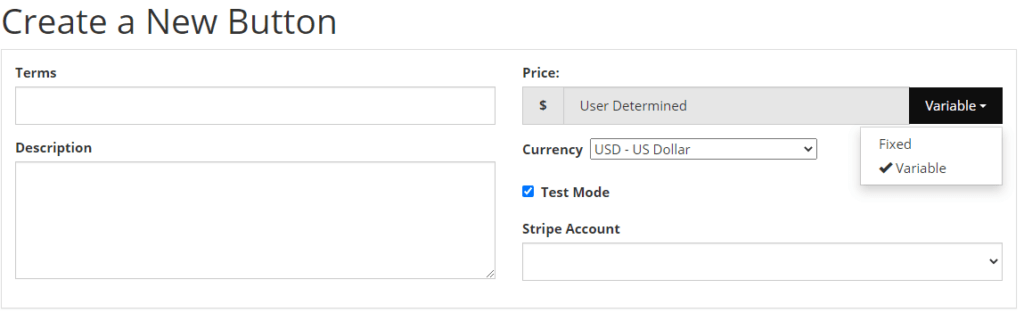

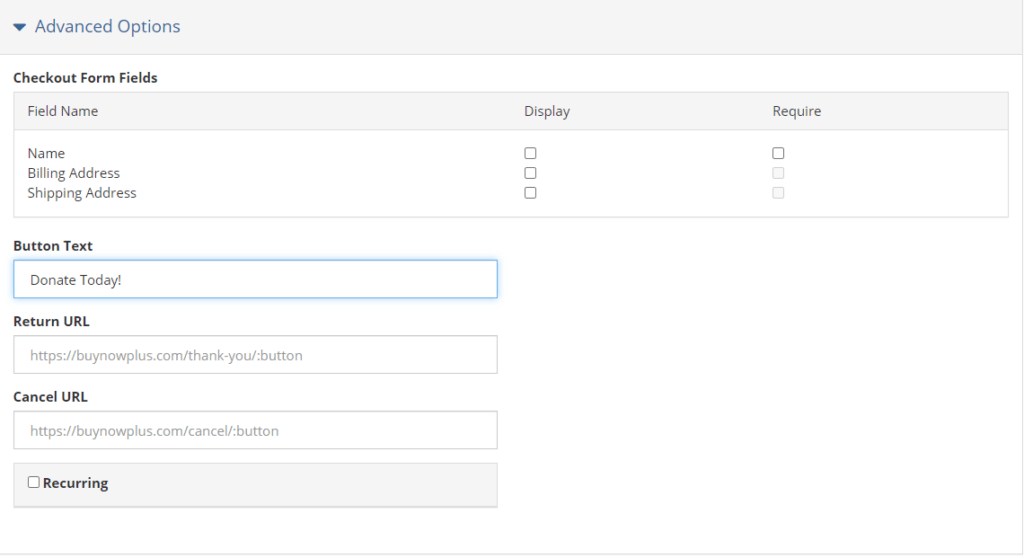

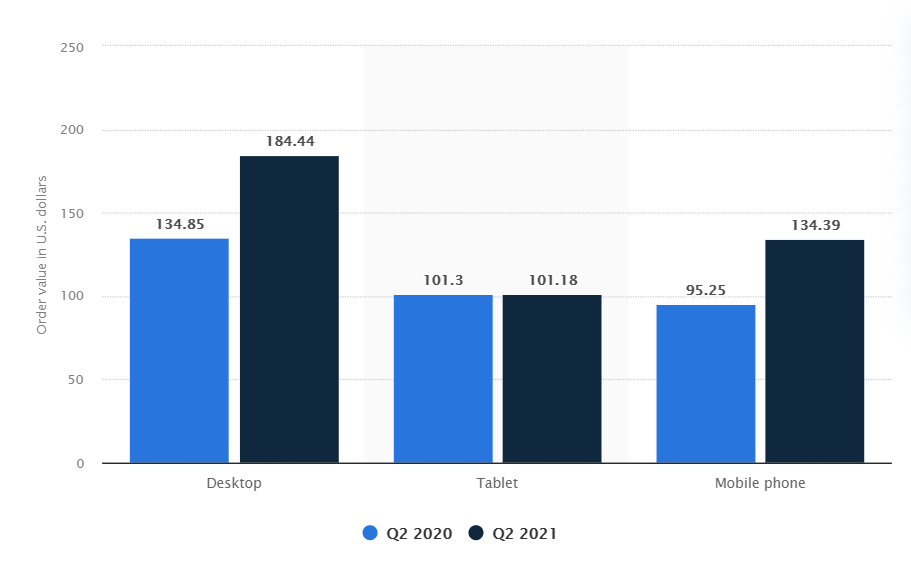

Cart abandonment is one of the main reasons that ecommerce businesses lose sales. This Baymard Institute study showed an average abandonment rate of almost 70%. Therefore, improving the checkout experience could be very worthwhile for your company.

A major reason for cart abandonment is the various hurdles a customer must overcome to complete a purchase. Factors such as load times, pop-ups, finding the checkout button, or too many input fields to complete can create friction.

As such, reducing friction is one of the most effective ways to decrease cart abandonment and increase sales.

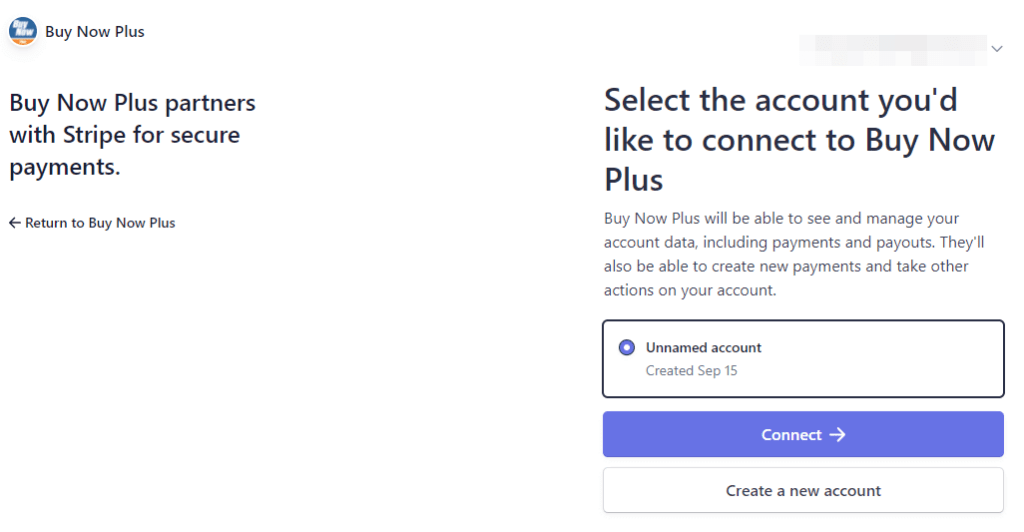

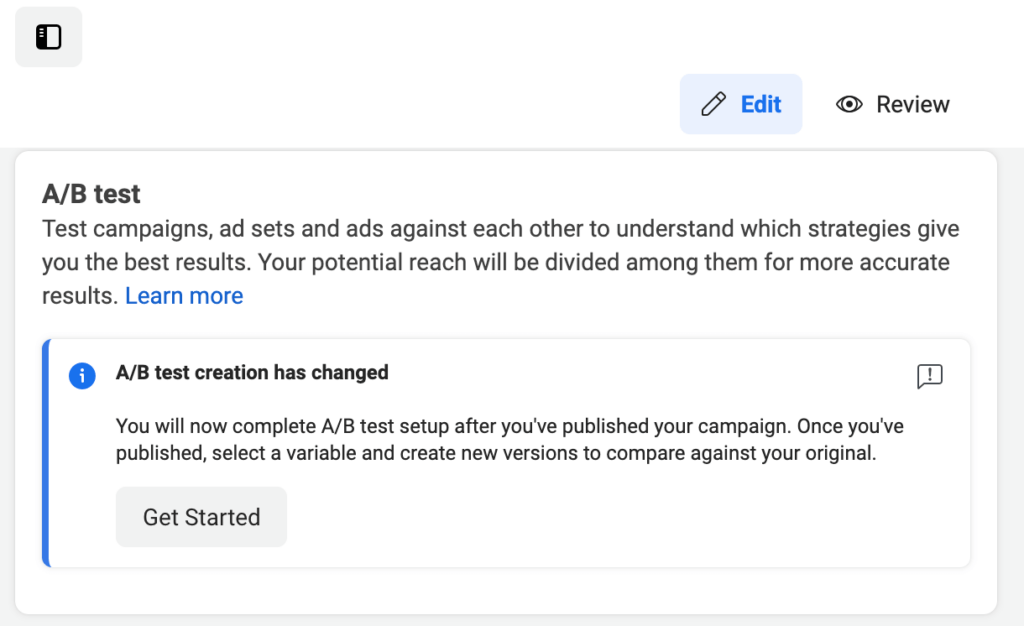

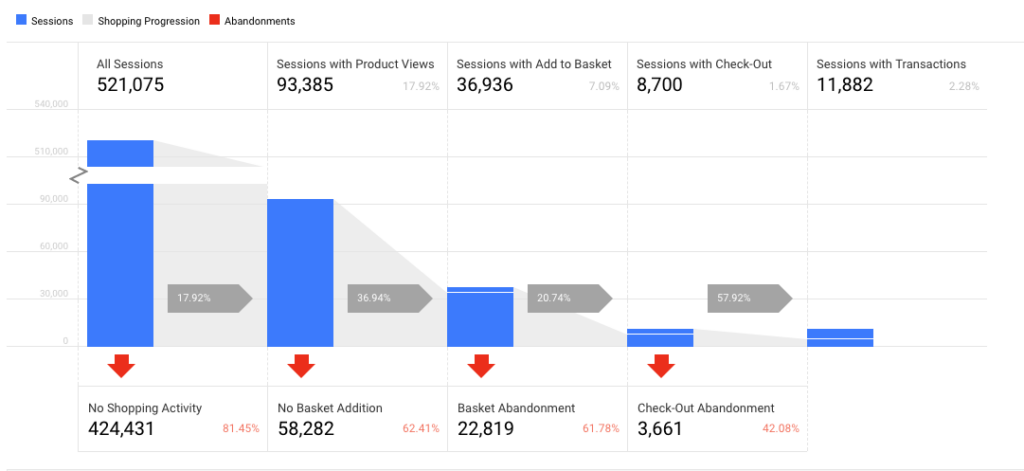

You can use big data to reduce friction in several ways, and you don’t need anything more powerful than Google Analytics. The platform has a Conversions and Shopping Behavior tab that displays this data:

To identify friction in your sales process, investigate when customers leave your site. Look closely at which stage consumers abandon the buying process, and you can identify trends.

For example, if a consumer has added items to a cart, they may just be shopping on multiple sites simultaneously. If they’ve made it to the checkout page and then left, there may be too many obstacles in their way.

4. Personalize the Customer Experience

Personalization is key to doing business. Consumers even expect it, especially with ecommerce.

For example, a study found that 80% of consumers like to receive emails with product recommendations similar to previous purchases they’ve made:

In addition to targeted marketing, you can personalize the customer experience by using a visitor's preferred currency and language. You can even use greetings for repeat buyers to encourage loyalty and win their business in the long term.

Using surveys is a great way to gather tons of relevant data about consumer preferences. You can then utilize this information to personalize their experiences.

Conclusion

Big data is powerful. Massive corporations and small businesses alike can use it to improve their operations and make better-informed decisions. However, this information can also be overwhelming without a clear plan of action.

Let’s take another quick look at how small businesses can take advantage of big data:

- Improve customer service to upgrade the buying experience and earn customer recommendations.

- Create buyer personas to better understand your customers and improve marketing.

- Decrease cart abandonment by identifying points of friction and improving your conversion rates.

- Personalize the customer experience to encourage consumer loyalty.

Do you have any questions about big data for small ecommerce businesses? Let us know in the comments section below!

If you liked this post, be sure to follow us on Twitter, Facebook, Pinterest, and LinkedIn!